Difference in Fdi Explain Japan Ireland

The author is an Economist at the Fiscal Policy Office Thailand andacknowledges financial support for. Internalization theory Vernons product life cycle theory and Knickerbockers theory of FDI.

Foreign Direct Investment Economics Help

Visit the MSU globalEDGE website.

. SPE FDI actually increased in 2015 by. What factors explain this difference. This article addresses Irelands record in attracting foreign direct investment FDI.

Lasting interest differentiates FDI from foreign portfolio investments where investors passively hold securities from a foreign country. Internalization theory Vernons product life cycle theory and Knickerbockers theory of FDI. Based on figures for 2003 Japans ratio of inward FDI to outward FDI was 027.

As of February 2019 the GOI is working on a road map to achieve its goal of USD 100 billion worth of FDI inflows. In 2008 inward FDI accounted for some 637 percent of gross fixed capital formation in Ireland but only 41 percent in Japan gross fixed capital formation refers to investments in fixed assets such as factories warehouses and retail stores. Ireland has a well-educated relatively low cost workforce and an abundant supply of labor while Japans workforce also well-educated is expensive.

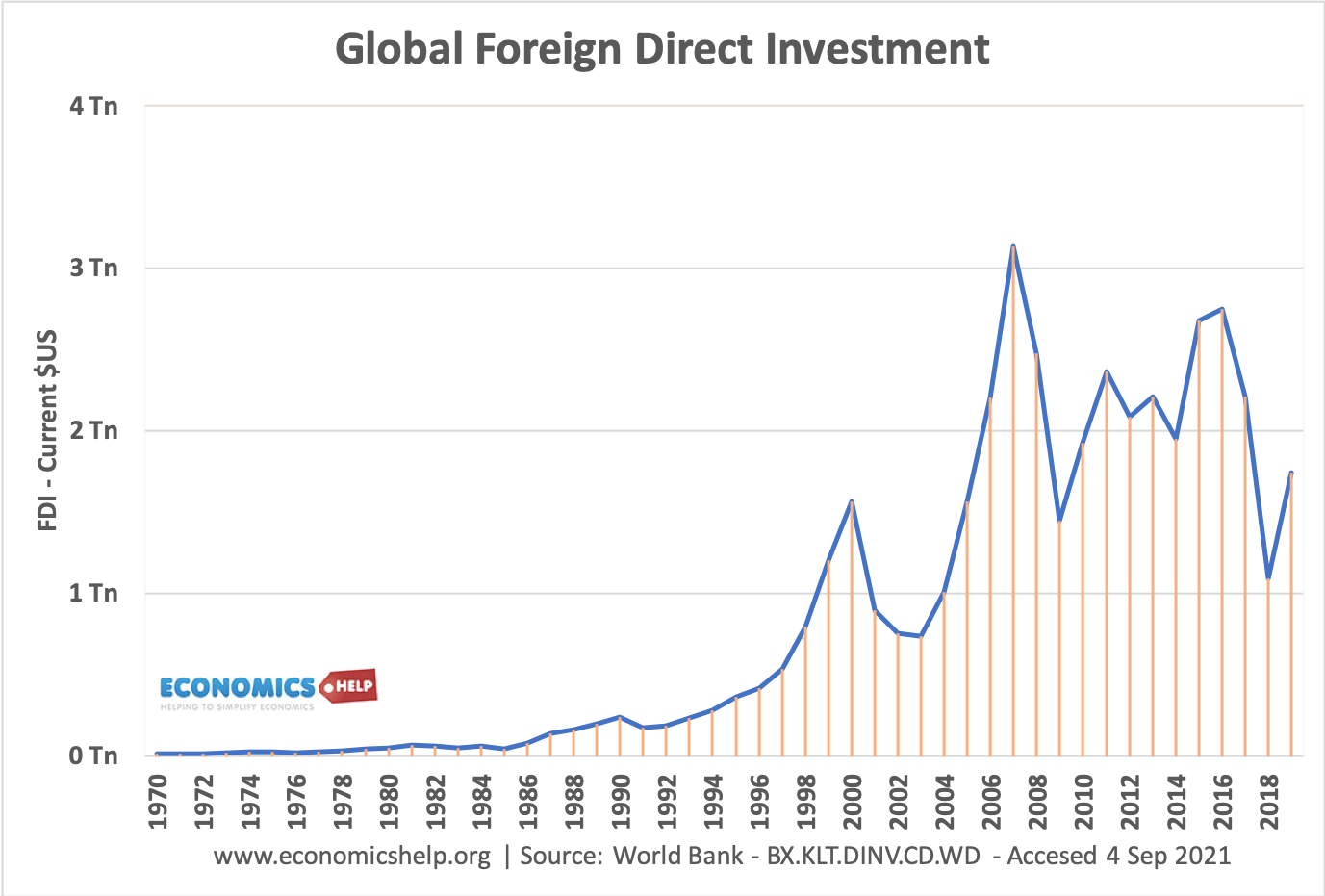

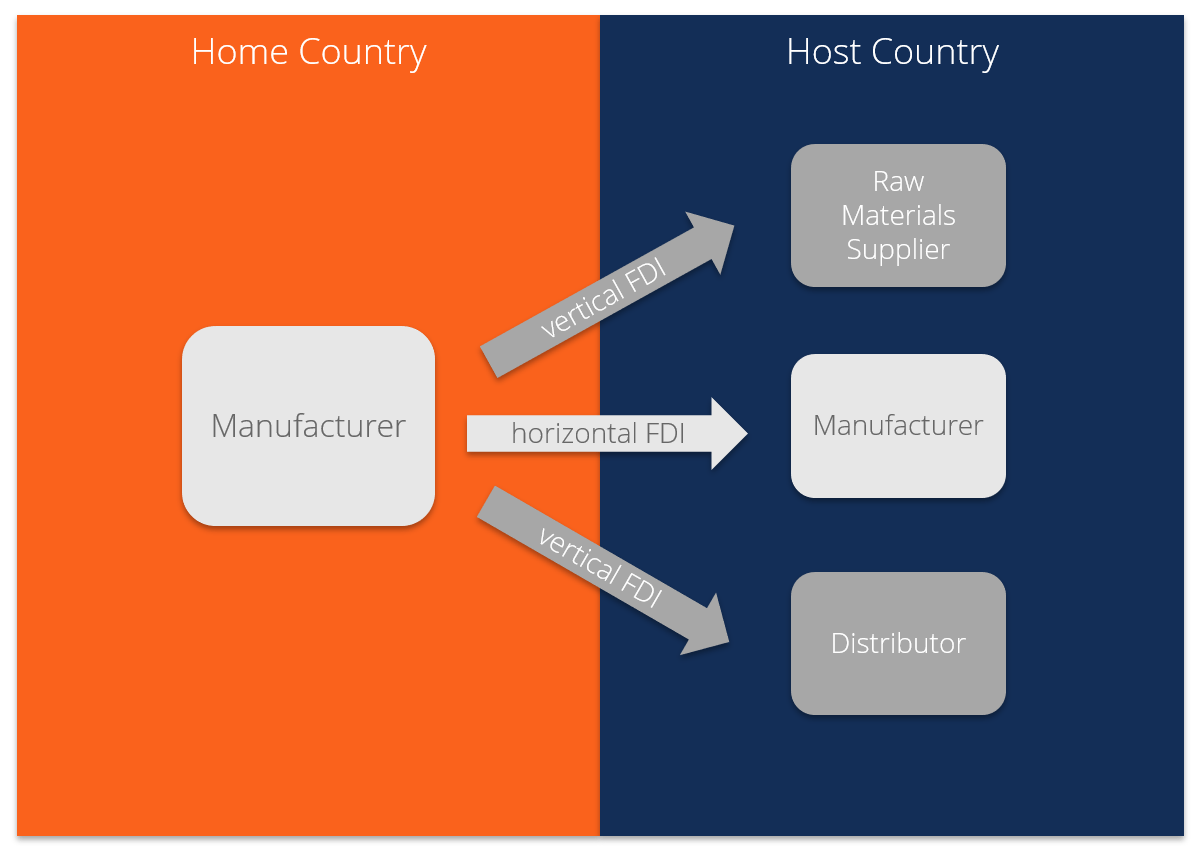

What do you think explains this difference in FDI inflows into the two countries. Demographics also help explain Japans outward foreign-direct investment. 2 FDI can take the form of investment in new assets greenfield investment or acquisition of existing assets mergers and acquisitions.

In 2008 inward FDI accounted for some 637 percent b. In 2004 inbound FDI accounted for 24 of gross fixed capital formation in Ireland but only 06 in Japan. During FY 2018-19 India received the maximum FDI equity inflows from Singapore USD 1623 billion followed by Mauritius USD 808 billion Netherlands USD 387 billion USA USD 314 billion and Japan USD 297 billion.

One in four people in Japan will be older than 65 in 2014 compared with 96 percent in China and 142 percent in the US. What is the value that Cemex brings to a host of gross fixed capital formation in Ireland but only 41 percent in Japan gross fixed capital formation refers to investments in fixed assets such as factories warehouses and retail stores. In 2004 inward FDI accounted for approximately 24 percent of gross fixed capital formation in Ireland but only 06 percent in Japan explain these differences in.

FDI Inflow Differences In 2008 inward FDI accounted for some 637 percent of gross fixed capital formation in Ireland but only 41 percent in Japan gross fixed capital formation refers to investments in fixed assets such as factories warehouses and retail stores. This article addresses Irelands record in attracting foreign direct investment FDI. FDI has been identified as one of the key factors that has spurred the growth of the Celtic Tiger.

Prepared by Suteera Sitong. In 2004 inward FDI accounted for some 24 percent of gross capital formation in Ireland but only 06 percent in Japan. This compares to ratios for the US Britain Germany and France of between 06 and 09.

In 2004 inbound FDI accounted for 24 of gross fixed capital formation in Ireland but only 06 in. FDI Inflow Differences In 2008 inward FDI accounted for some 637 percent of gross fixed capital formation in Ireland but only 41 percent in Japan gross fixed capital formation refers to investments in fixed assets such as factories warehouses and retail stores. Explain the difference in FDI inflows.

An article in the Irish Times recently claimed that in Ireland the multiple is about 07 local jobs for each direct job created by a foreign firm Irish Times 2010. Wang and Wong 2009 find that greenfield FDI promotes economic growth while MAs promote growth only when the host. Despite the increase of FDI since the mid-1990s Japan continues to have the smallest inflow of foreign investments.

The first index compares inward FDI with outward FDI. Foreign direct investment FDI is an investment from a party in one country into a business or corporation in another country with the intention of establishing a lasting interest. The stock of FDI in Japan did not account but for 4 of the GDP at the end of 2009.

Most visibly collaborations between FDI and local firms create jobs. What do you think explains this difference in FDI inflows into the two countries. The flow of FDI had slowed down due to the global economic crisis and they started to pick up again at a slow rhythm.

Do some research on Japan and Ireland. Critical Thinking and Discussion Questions 1. An adaptation of Porters Diamond is offered to explain the determinants of Irelands competitive advantage in attracting FDI.

Because of their distinctive characteristics the two FDI modes may have different welfare effects in host countries. Ireland has a well-educated relatively low cost workforce and an abundant supply of labor while Japans workforce also well-educated is expensive. The overall trends in FDI inflows to Ireland are considered.

We can thus see that Japans inward FDI is extremely low compared to its outward FDI. In 2008 inward FDI accounted for some 637 of gross fixed capital formation in Ireland but only 41 in Japan gross fixed capital formation refers to investments in fixed assets such as factories warehouses and retail stores. Taking Ireland and Japan for instance Ireland was estimated to have made 28 million in inward FDI flow with a 336 rate in 2017 and an outward flow of 18 million with a 216 rate in 2017.

FDI has been identified as one of the key factors that has spurred the growth of the Celtic Tiger. Visiting Scholar Policy Research Institute Ministry of Finance Japan. Gross capital formation summarizes the total amount of capital invested in factories stores office buildings and so on.

Gross fixed capital formation refers to investments in fixed assets such as factories warehouses and retail stores. Yet the pickings from FDI are getting ever thinner as more and more countries compete for global investments. Figure 103 shows that SPE presence in Ireland has remained in between approximately 3-5 with the percentage standing at 4 in 2018.

In 2004 inward FDI accounted for some 24 percent of. Where as Japan has an inward FDI flow of and made over 10 million with a 9 rate in 2017 and an outward flow of 160 million with a 142 rate. What do you think explains this difference in FDI inflows into the two countries.

The decrease that occurs in 2015 is as a result of the large increase in total FDI positions for that year which was due to the financing of intellectual property in Ireland. The ASEAN Economic Integration and Foreign Direct Investment. Compare and contrast these explanations of FDI.

A Case Study of Japans FDI on the Automotive Industry. In 2008 inward FDI accounted for some 637 of gross fixed capital formation in Ireland but only 41 in Japan note. Compare and contrast these explanations of FDI.

In 2004 inward FDI accounted for some 24 percent of gross fixed capital formation in.

Foreign Direct Investment Fdi Overview Benefits Disadvantages

The Quest For Fdi Visual Ly Investing Infographic Investment House

Ireland S Percentage Share Of Total Inward Fdi To Europe And From Download Scientific Diagram

Comments

Post a Comment